Contributors

Average contract value (or ACV) is an important metric that businesses use to measure the success of their sales. It measures the average amount of money customers spend on a particular product or service. If your average contract value is low, it could indicate that you’re not targeting customers who have the ability to pay more—and if your ACV is too high, it may be difficult to acquire new customers. In this blog post, we’ll discuss what Average Contract Value is, how to calculate it, and why it’s important for businesses.

Average contract value (ACV) refers to the average amount of money a customer spends when they purchase a product or service from your business. The higher the average contract value, the more profitable your business will be. ACV also gives you insight into customer behavior and lets you know whether or not you’re targeting customers who have the ability to pay more for what you offer.

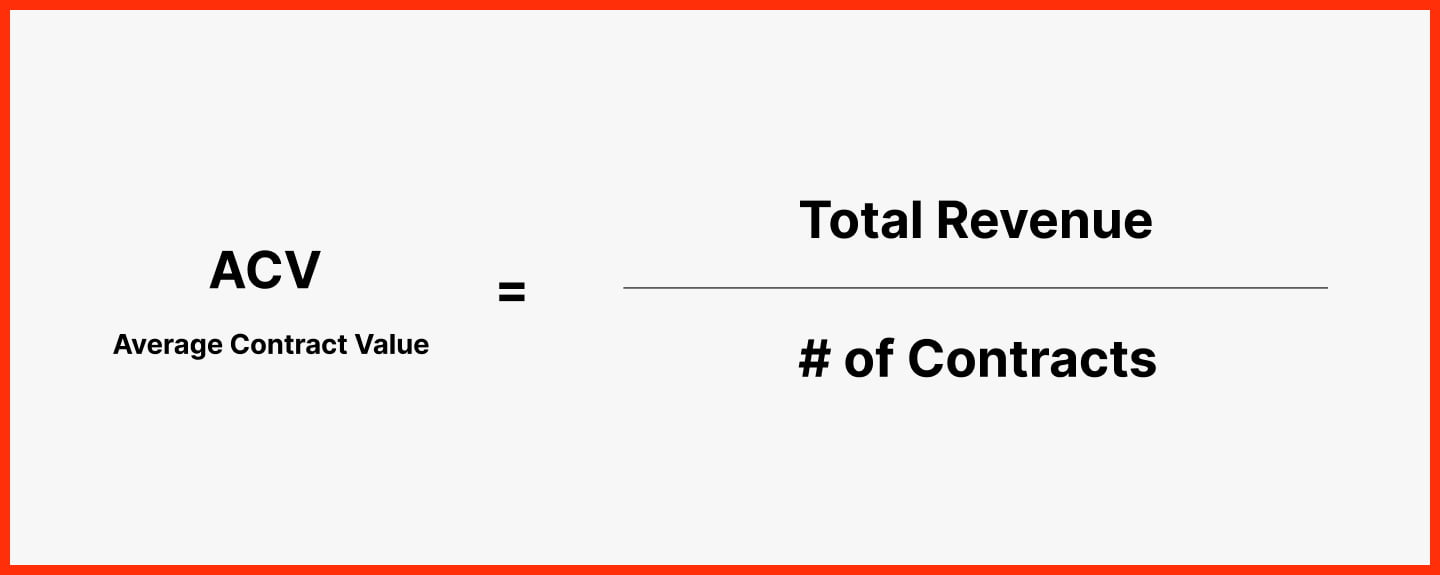

Calculating ACV is fairly straightforward; all you need to do is add up all of your contracts over a certain period of time and divide that sum by the total number of contracts in that period.

For example, if your business had 10 contracts over 6 months with an average revenue per contract of $1,000 each month, then your average contract value would be $1,000 ($10,000 ÷ 10).

Average contract value gives businesses valuable insight into their customer base and helps them understand what types of products/services their customers are willing to pay for. It can also help them set pricing strategies for their products/services to maximize profits while still offering competitive prices.

Additionally, understanding ACV allows businesses to determine which marketing channels are most effective at driving sales and revenue growth.

Understanding your Average Contract Value (ACV) can help businesses better target potential customers who have the ability to spend more on their product or service while setting pricing strategies that maximize profits without sacrificing quality or competitiveness.

By calculating ACV regularly and using it as a benchmark for success, businesses can gain insight into their customer base while making informed decisions about their pricing models and marketing efforts. With this knowledge in hand, companies can become better equipped to grow their revenues and realize greater success in the long run!

Average Contract Value (ACV) is a metric that calculates the average revenue generated per contract, typically in a recurring revenue business model. It is calculated by dividing the total revenue by the number of contracts.

ACV is important because it helps businesses understand the value of their customer relationships. It can also be used to measure the effectiveness of sales and marketing efforts, and to predict future revenue. Additionally, a higher ACV indicates a higher lifetime value of a customer.

ACV is calculated by dividing the total revenue by the number of contracts. For example, if a company generated $500,000 in revenue from 100 contracts, the ACV would be $5,000 ($500,000 / 100).

ACV is used in forecasting to predict future revenue based on the number of new contracts and the expected ACV. For example, if a company expects to add 50 new contracts with an ACV of $5,000, they can forecast an additional $250,000 in revenue ($5,000 x 50).

Factors that can affect ACV include the number of products or services included in the contract, the length of the contract, and the level of customization or support provided. Additionally, the company’s pricing strategy can also affect ACV.

ACV and CAC are two different metrics that provide different insights into a business’s financial performance. ACV measures the value of customer relationships, while CAC measures the cost of acquiring new customers. It’s important to understand both metrics to get a complete picture of a business’s financial performance and to make informed decisions about future investments.